Hanwha Group (HG) is highly likely to be the new owner of DSME. The acquisition price is known to be around 2 trillion KRW (~$1.4 billion), which is only one-third of the price that HG wished to pay when it tried to buy DSME in 2008. If there are no other competing investors that propose better buyout conditions than Hanwha already finalized today, DSME’s ownership would belong to the Group by the end of this year. The whole DSME will be sold instead of split sales.

HG signed an MOU with DSME on September 26, acquiring 49.3 percent of DSME’s shares through a paid-in capital increase from the largest stakeholder of DSME, KDB Bank of Industry. Hanwha Aerospace and Hanwha Systems will respectively invest 1 trillion KRW (~$700 million) and 500 billion KRW (~$350 million), followed by Hanwha Impact Partners which would invest 400 billion KRW and three affiliates of Hanwha Energy that will invest 100 billion KRW (~$70 million). KDB Bank of Industry will stay as a smaller shareholder that does not have management rights but only has 28.2 percent of shares.

The Group’s strategy to focus on the defense industry has played a critical role for the company to be the one that merges DSME. It is currently reorganizing its business structure based on a plan to foster the defense industry as its future, thinking of transforming itself to ‘Korean Lockheed Martin’ by merging the defense sectors of Hanwha Corporation and Hanwha Defense into Hanwha Aerospace.

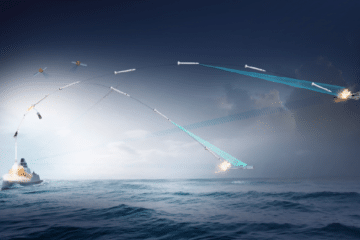

Due to the acquisition of DSME which is specialized in special shipbuilding intended for naval ships and submarines, HG is expected to be the top Korean defense conglomerate that possesses the strongest ground, naval, air defense industrial cluster. This would enable the company to expand its business scope to MRO (maintenance and repair) market.

If the sides mutually share their customer network, there will be synergies to increase defense exports, also applying future defense knowledge to civilian merchant ships by increasing the R&D investment of DSME.

“We could acquire the capability to develop autonomous merchant ships if state-of-the-art maritime system technology of Hanwha Systems and DSME’s shipbuilding capacities are combined.”

Hanwha Group

Hanwha is optimistic that DSME could mark a turnaround early in the current situation where the shipbuilding industry is being revitalized with high exchange rates. DSME already has remaining shipbuilding contracts worth $28.8 billion (41 trillion KRW) for the next 4 years.